Research Report on the Public Relations Market

1. Public Relations Market - Overview

1.1 Definitions and Scope

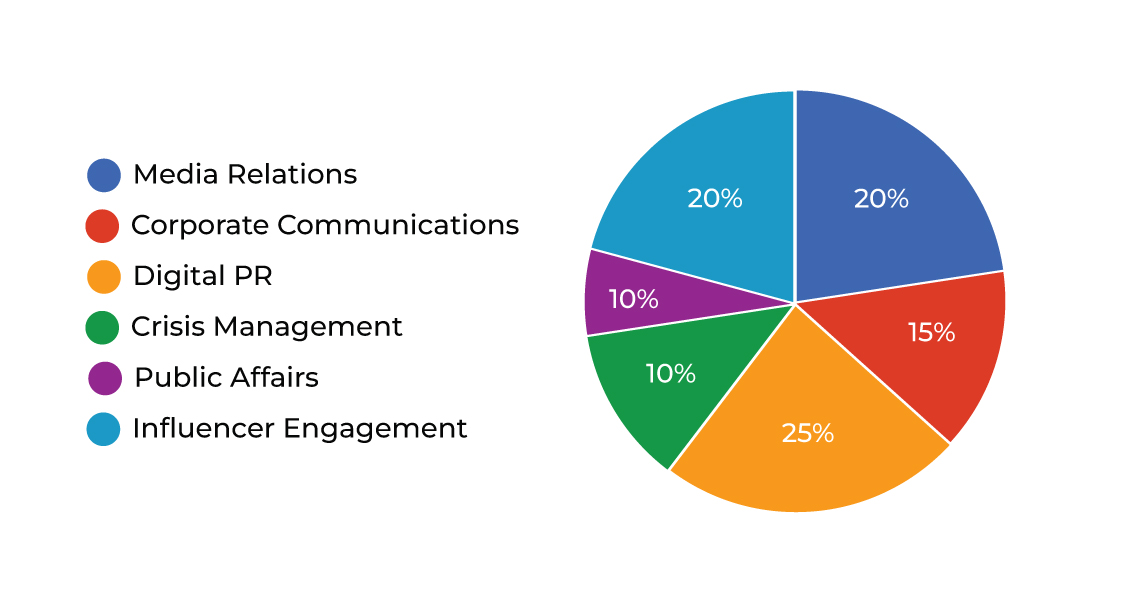

Public Relations (PR) is a process that promotes mutually beneficial relationships between organisations and their various publics, including customers, employees, investors, and the general public. In the Indian market context, PR encompasses multiple activities, such as media relations, corporate communications, digital PR, crisis management, public affairs, and influencer engagement.

The scope of PR in India is expanding significantly due to several factors, including rapid digital transformation, increased use of social media, and a growing emphasis on reputation management in an interconnected world. PR is no longer limited to traditional media relations; it has evolved to include digital strategies like social media management (SMM), content marketing, and data analytics. The integration of these new-age technologies has empowered PR professionals to effectively target and engage specific audiences, deliver measurable results, and provide real-time communication solutions.

For example, digital PR strategies now involve sophisticated tools for social media monitoring, AI-driven sentiment analysis, and big data analytics to tailor communication strategies to specific audience segments. Additionally, regional languages and localised content have become essential in a diverse market like India, where cultural nuances significantly impact communication effectiveness.

With India's economy proliferating and businesses becoming more competitive, PR has gained strategic importance in driving brand visibility, managing corporate reputations, and engaging with stakeholders. As a result, PR is increasingly recognised as a critical business function, leading to more substantial investments in PR activities. This trend is evident across various sectors, such as BFSI, healthcare, IT, and consumer goods, where companies are actively leveraging PR to navigate regulatory challenges, build thought leadership, and manage crises.

2. Public Relations Market - Executive Summary

2.1 Market Revenue, Size, and Key Trends by Company

The Indian PR industry has demonstrated robust growth over the past decade, achieving consistent double-digit growth rates. As per the 2022-23 SPRINT report by the Public Relations Consultants Association of India (PRCAI), the market size stood at INR 2,100 crore (approximately USD 260 million) in FY 2022-23. In spite of the challenges created by the COVID-19 pandemic, the industry has shown resilience, driven by increasing demand for strategic communication and reputation management services.

2.2 Key Trends by Type of Application

The digital transformation of the PR industry has been one of the most significant trends in recent years. With the increased use of digital and social media platforms, PR professionals increasingly leverage these channels to engage with target audiences in real-time. The SPRINT report indicates that 77% of respondents have noted an increased integration of digital and traditional PR, while 75% believe that automation will bring more efficiency to PR processes.

2.3 Key Trends Segmented by Geography

2.3.1 Definitions and Scope

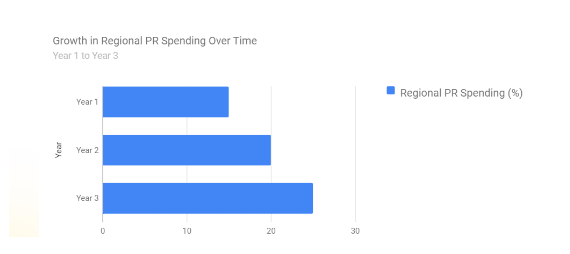

Geographically, the Indian PR market is characterised by significant regional growth, particularly in Tier 2 and Tier 3 cities. The SPRINT report reveals that regional PR spending has increased from 15% of total PR budgets three years ago to 25% today, with further growth expected in the future. Outstanding growth is driven by the increasing recognition of the importance of localised communication strategies that cater to India's diverse cultural and linguistic landscape. For example, regions like Gujarat, Punjab, and Tamil Nadu have seen a surge in demand for regional PR services, particularly from SMEs and local businesses looking to improve or increase their brand presence and engage with local communities more effectively.

Successful regional PR campaigns, such as those conducted by Fuzion PR in Tier 2 cities like Jaipur and Indore, have demonstrated the power of localised content and culturally relevant messaging. These campaigns leverage local media outlets, influencers, and community events to build trust and visibility among local audiences. This shift towards regional PR will continue as more businesses recognise the value of targeted, culturally resonant communication strategies.

3. Public Relations Market

3.1 Comparative Analysis

3.1.1 Product Benchmarking - Top 10 Companies

The top 10 PR companies in India, including Adfactors PR, Edelman, Weber Shandwick, Ruder Finn, and Public Media Solution, offer diverse services catering to various communication needs. These services include media relations, crisis communication, digital PR, influencer engagement, public affairs, and content creation. Each company has unique strengths and areas of specialisation that differentiate it from the competitive landscape.

For instance, Adfactors PR is known for its strong presence in the financial and corporate sectors, while Edelman focuses on digital and social media strategies. Weber Shandwick is recognised for its expertise in crisis communication and public affairs, whereas Ruder Finn is known for its innovative use of technology and data analytics in PR campaigns. Public Media Solution stands out for its strategic approach to digital PR and comprehensive media outreach. This diverse range of services and specialisations allows these companies to cater to various clients, from large multinational corporations to emerging startups.

3.1.2 Top 5 Financials Analysis

The financial performance of the leading PR firms, including Public Media Solution, reflects their capability to adapt to changing market dynamics and provide value to their clients. The SPRINT report indicates that the top PR firms in India have shown robust revenue growth, driven by increased demand for strategic communication services. Profit margins have also expanded as companies invest in digital tools and technologies to enhance their service offerings and improve operational efficiency.

For example, mid-sized firms have demonstrated the highest growth rates, with a 19.5% increase in revenue in FY 2022-23. This growth can be attributed to their agility and ability to offer specialised services that meet the evolving needs of their clients. In contrast, larger firms have focused on expanding their digital capabilities and integrating traditional and digital PR strategies to maintain their competitive edge.

3.1.3 Market Value Split by Top 10 Companies

The market value of India's top 10 PR companies is significant, with a substantial share of the total market revenue concentrated among these players. Adfactors PR, for instance, is a market leader, commanding a substantial portion of the market due to its extensive client base and comprehensive service offerings. Similarly, Edelman, Weber Shandwick, Ruder Finn, and Public Media Solution have also secured substantial market shares through their innovative strategies and global reach.

The concentration of market value among these top players reflects the competitive nature of the PR industry in India, where differentiation through service innovation, client relationships, and market expertise is critical to maintaining market leadership.

3.1.4 Patent Analysis - Top 10 Companies

Innovation is critical for success in the PR industry, particularly as digital transformation reshapes the communication landscape. Leading companies like Edelman, Weber Shandwick, and Public Media Solution have invested significantly in proprietary tools and technologies to enhance their service offerings and maintain a competitive edge

For instance, Edelman has developed AI-driven media monitoring platforms that use natural language processing to analyse sentiment and identify emerging trends across multiple languages, including regional Indian languages. Weber Shandwick's proprietary crisis management tool, "Crisis Comms Manager," uses predictive analytics to anticipate crises and recommend proactive communication strategies.

Public Media Solution has also invested in innovative digital tools such as its "Creators Genie" platform. This plan uses machine learning algorithms to identify and engage with key influencers across social media channels, tailoring content to maximise impact. These innovations enable firms to deliver more accurate and timely insights to their clients, thereby improving the effectiveness of PR campaigns.

Patent analysis indicates that the top PR companies are increasingly focusing on developing intellectual property related to digital tools and technologies. This trend will continue as firms seek to differentiate themselves in a highly competitive market, particularly in AI-driven media analysis, predictive crisis management, and influencer engagement.

3.1.5 Pricing Analysis

Pricing strategies in the Indian PR industry are evolving in response to changing client expectations and market dynamics. The SPRINT report highlights a shift towards value-based pricing, where clients are willing to pay more for services that deliver measurable results. This trend reflects the growing importance of strategic communication and the need for PR firms to demonstrate their impact on business outcomes

While traditional media relations services remain price-sensitive, digital PR and content marketing services command higher prices due to their ability to provide data-driven insights and real-time audience engagement. As a result, PR firms are increasingly focusing on developing capabilities in these areas to enhance their value proposition to clients.

4. Public Relations Market - Startup Companies Scenario

4.1 Top 10 Startup Company Analysis

4.1.1 Investment

The Indian PR market is witnessing a surge in investment in startups, particularly those focusing on innovative digital PR solutions. As digital transformation reshapes the PR landscape, there has been a notable increase in venture capital and private equity funding directed toward PR startups. According to the PRCAI SPRINT report, investors are growing interested in companies that utilise AI, big data analytics, and social media monitoring tools to offer more targeted and effective communication strategies

Startups such as Fuzion PR, Blue Lotus Communications, and Wizikey have attracted significant investments by leveraging technology to deliver value-driven solutions. These companies focus on niche segments such as regional PR, digital content creation, and influencer engagement, appealing to local and global investors.

4.1.2 Revenue

The revenue generated by PR startups in India is growing, driven by their ability to cater to the unique needs of digital-native businesses and regional markets. Startups focusing on digital PR, social media management, and content marketing have reported significant revenue growth over the past few years. For example, Wizikey, a startup that uses data analytics to predict media trends, has seen its revenue increase by 25% annually since its inception.

4.1.3 Market Shares

Although startups hold a smaller market share than established PR firms, their influence proliferates, particularly in digital PR and content marketing. Startups are capturing around 10-15% of the overall market, with projections suggesting this could rise significantly as digital adoption expands across industries.

4.1.4 Market Size and Application Analysis

Startups are mainly concentrated in high-growth areas such as content creation, content marketing, social media management, and influencer marketing. The rise in digital media and the demand for localisation have created opportunities for startups to expand their offerings. Startups are also focusing on specific applications like crisis management, where they utilise AI-driven tools to predict and manage crises in real time.

4.1.5 Venture Capital and Funding Scenario

Venture capital (VC) funding in the PR sector has steadily increased. VC firms are particularly interested in startups demonstrating innovative approaches, such as machine learning for sentiment analysis or blockchain for transparency in influencer marketing. Companies like Wizikey and Qoruz have successfully raised funds from notable VCs, reflecting the growing investor confidence in the PR sector.

5. Public Relations Market - Industry Market Entry Scenario

5.1 Regulatory Framework Overview

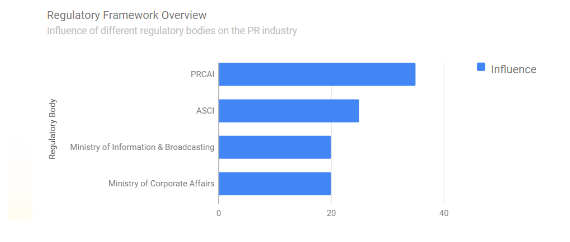

Multiple guidelines and regulations set by professional bodies and government authorities shape the regulatory framework governing the PR industry in India. The Public Relations Consultants Association of India (PRCAI) is critical in maintaining industry standards, promoting ethical practices, and fostering transparency among PR practitioners.

Recent regulatory changes, such as the amendments to the Information Technology Rules, 2021, have implications for digital PR activities, particularly regarding content moderation and compliance. The Advertising Standards Council of India also sets advertising and promotional content guidelines, ensuring that PR campaigns adhere to ethical standards and avoid misleading communication.

The Ministry of Information and Broadcasting also oversees compliance with broadcasting standards, while the Ministry of Corporate Affairs regulates corporate communications related to public disclosures. These regulations ensure that PR practices in India maintain high transparency, accuracy, and ethical conduct.

However, the industry needs help navigating these regulatory frameworks, particularly regarding data privacy laws like the Personal Data Protection Bill. These laws impact how PR firms handle personal data and conduct digital marketing campaigns. Understanding these regulations is critical for PR firms to operate effectively in India’s complex legal environment.

5.2 New Business and Ease of Doing Business Index

India has become increasingly conducive to new business ventures, including PR firms. The government’s focus on enhancing the ease of doing business through initiatives such as 'Make in India' and 'Startup India' has created a favourable environment for new entrants. As per the World Bank's Ease of Doing Business Index, India has seen significant improvements, ranking 63rd in 2022, compared to 142nd in 2014.

However, the PR industry still faces challenges, including navigating bureaucratic hurdles, managing talent acquisition, and dealing with pricing pressures. Despite these obstacles, the increasing demand for PR services, especially in digital and regional markets, makes India an attractive destination for new businesses.

5.3 Case Studies of Successful Ventures

Several PR firms in India have capitalised on digital trends and regional opportunities. For example:

-

Adfactors PR:This firm has expanded its footprint by leveraging digital tools and building strong client relationships across the finance, technology, and healthcare sectors. Its focus on delivering measurable results has positioned it as a market leader.

-

Fuzion PRKnown for its innovative regional PR strategies, Fuzion PR has successfully tapped into Tier 2 and 3 cities, capturing a significant market share by offering localised content and tailored communication strategies.

-

Public Media Solution:Distinguished for its strategic integration of digital and traditional PR, it has excelled in healthcare, technology, and consumer goods by offering a combination of data-driven strategies and personalised media engagement.

-

WizikeyA data-driven startup, Wizikey has successfully differentiated itself by offering predictive analytics to help clients understand media trends and make informed PR decisions.

5.4 Customer Analysis - Top 10 Companies

The top PR companies in India, such as Edelman, Weber Shandwick, Public Media Solution and Ruder Finn, have built strong customer bases by offering comprehensive services that meet diverse communication needs. These firms cater to various clients, from multinational corporations to startups, across multiple sectors, including BFSI, healthcare, IT, and consumer goods.

Clients increasingly expect PR firms to deliver strategic value, with 72% of CEOs and CFOs actively participating in PR strategy formulation. This shift reflects a growing demand for PR firms to offer tactical communication support and strategic advisory services that align with overall business objectives.

6. Public Relations Market Forces

6.1 Drivers

Key drivers propelling the growth of the PR market in India include:

-

Digital TransformationThe increasing adoption of digital tools and platforms for PR activities, such as social media management, content marketing, and digital analytics, is driving industry growth.

-

Rising Importance of Reputation ManagementOrganizations are investing more in PR to protect and enhance their reputations in an era of instant communication and global reach.

-

Growth in Regional Markets: The shift towards regional PR has opened new opportunities, particularly in Tier 2 and 3 cities, where localised communication strategies are gaining prominence.

6.2 Constraints

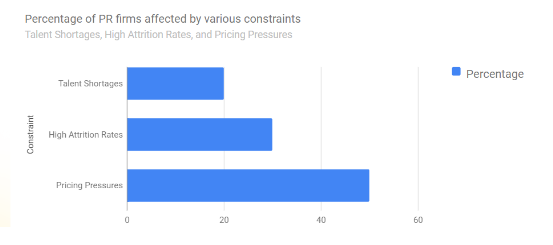

The Indian PR industry faces several constraints that impact its growth and operational efficiency:

-

Talent Shortages:The industry needs more skilled professionals, particularly in digital PR, data analytics, and content creation. The attrition rate in the PR industry is around 20%, higher than global standards. This shortage is further exacerbated by the demand for multi-skilled professionals who can navigate traditional and digital PR landscapes.

-

High Attrition Rates: High turnover rates are a significant challenge, especially among mid-level professionals. The mismatch between compensation expectations and actual skill levels contributes to this issue, leading to frequent talent churn and increased recruitment costs

-

Pricing Pressures:Intense competition among PR firms has led to pricing pressures, affecting profitability and service quality. Clients increasingly demand measurable results and value for money, forcing PR firms to balance cost management with delivering high-quality services.

To mitigate these constraints, PR firms are investing in upskilling programs, adopting flexible work models to retain talent, and focusing on specialised services that command premium pricing. However, overcoming these challenges requires sustained efforts to align workforce capabilities with market demands and enhance operational efficiencies.

6.3 Challenges faced by Public Relations Agencies

1. Maintaining Credibility and Trust

Credibility is the cornerstone of any PR agency. Establishing and maintaining trust is essential not only with the clients but also with journalists, stakeholders, and the general public. One small misstep—such as sharing misleading information or making exaggerated claims—can severely damage both the agency’s and its client’s reputation.

Challenge Details:

-

Pressure to Show Results:Agencies often face pressure to show quick results, leading to the temptation to stretch the truth or misrepresent facts.

-

Public Scrutiny: With social media, even small mistakes can go viral, making transparency and accuracy more crucial than ever.

-

Ethical Dilemmas:Balancing clients’ demands with ethical practices can be challenging, especially when managing sensitive or controversial topics.

Evolving Media Landscape

The media landscape has drastically changed over the past decade. With the rise of digital media, social networks, and influencer marketing, traditional media is no longer the only focus for PR agencies. This shift requires agencies to adopt new tools, strategies, and platforms to stay relevant.

Challenge Details:

-

Digital Dominance:The rapid pace at which new digital platforms emerge (e.g., TikTok, Clubhouse) means agencies need to stay updated.

-

Changing Content Formats:With shorter attention spans, content needs to be more visual, interactive, and engaging.

-

Influencer Marketing: Managing relationships with influencers, who are often unpredictable, adds a new dimension to PR strategies.

Measuring ROI (Return on Investment)

Unlike digital marketing, where metrics such as clicks, conversions, and impressions are measurable, PR success is often more nuanced. Agencies struggle to quantify intangible benefits like brand reputation, trust, and public sentiment.

Challenge Details

-

Lack of Standard Metrics:The impact of PR efforts like media mentions, audience reach, or sentiment analysis is hard to standardize

-

Client Expectations: Clients often look for direct business outcomes from PR efforts, which are hard to tie back to specific campaigns.

-

Long-Term Impact: PR is a long-term game, but clients often expect immediate results.

Managing Crisis Communications

Every organization faces crises at some point—whether it’s a scandal, a product recall, or a PR disaster. Managing these crises without damaging the brand image is one of the biggest challenges for PR agencies. A single miscommunication can escalate the situation, leading to reputational damage.

Challenge Details:

-

Speed of Response: In today’s 24/7 media environment, a delayed response can worsen the crisis.

-

Emotional Control:Managing client emotions and ensuring calm and rational communication is critical.

-

Stakeholder Management:Coordinating between internal and external stakeholders, including employees, customers, and media, requires precision.

Fake News and Misinformation

The rise of fake news and misinformation has become a significant challenge for PR agencies. False information can spread rapidly through digital channels, undermining PR efforts and damaging the reputation of the brands they represent

Challenge Details:

-

Difficulty in Containment: Once misinformation is out, controlling its spread can be extremely difficult.

-

Eroding Trust: Fake news can erode trust in the brand, even if the information is corrected later.

-

Reactive Crisis Management:

Agencies often need to adopt reactive strategies to counter misinformation, which may not always be effective.

Evolving Client Expectations

Clients today have evolved expectations from PR agencies. They no longer look at PR just for media coverage but expect measurable results, strategic consultancy, and integrated communication across channels.

Challenge Details:

-

Demand for Strategic Consultancy: Clients want PR firms to offer strategic guidance rather than just tactical execution.

-

Results-Oriented Approach: Agencies are expected to deliver tangible outcomes that contribute directly to business goals

-

Integration Across Channels:Clients seek integrated communication strategies that blend PR, social media, digital marketing, and influencer outreach.

Digital Disruption

The PR industry is undergoing a massive digital transformation. Rapid advancements in technology, such as artificial intelligence, automation, and data analytics, are reshaping how PR agencies function. Keeping up with these changes is challenging but necessary to remain competitive.

Challenge Details:

-

Need for Continuous Innovation: Agencies must constantly innovate to incorporate new tools and technologies into their workflow.

-

Training and Upskilling: The speed of digital transformation requires constant upskilling of employees.

-

Adapting to AI and Automation:Technologies like AI, machine learning, and automation are disrupting traditional PR practices, demanding a rethink of strategies.

Budget Constraints

PR agencies often operate under strict budget constraints. Clients, particularly startups or small businesses, expect high-impact results but allocate limited resources. This can restrict the scope of campaigns and reduce their effectiveness.

Challenge Details:

-

Cost of Tools:Monitoring, analysis, and automation tools essential for effective PR can be expensive.

-

Resource Allocation: Balancing multiple projects with limited resources can reduce campaign quality.

-

Unrealistic Expectations: Clients may expect comprehensive coverage or rapid results that exceed the given budget.

6.4 Porter's Five Force Model

6.4.1 Bargaining Power of Suppliers

The bargaining power of suppliers in the PR industry is relatively high due to the shortage of skilled talent. The industry’s high attrition rate further strengthens employees' negotiating power, who can demand higher salaries and better working conditions.

6.4.2 Bargaining Power of Customers

Customers have considerable bargaining power, primarily due to the competitive nature of the PR market. Clients are increasingly seeking value for money and expect PR firms to provide measurable results and demonstrate a direct impact on their business objectives.

6.4.3 Threat of New Entrants

The threat of new entrants is moderate. While the Indian PR market offers growth opportunities, new entrants face challenges such as building a solid client base, establishing credibility, and competing against established firms with long-standing client relationships.

6.4.4 Rivalry Among Existing Players

Rivalry among existing players is intense, especially among mid-sized and large firms. Price wars characterise the competitive landscape, undercutting retainer-ship fees and a race to adopt the latest digital tools and technologies to stay relevant.

6.4.5 Threat of Substitutes

The threat of substitutes is high, with digital marketing, content marketing, and influencer partnerships emerging as viable alternatives to traditional PR services. PR firms must continuously innovate and demonstrate value to maintain their relevance.

7. Public Relations Market - Strategic Analysis

7.1 Value Chain Analysis

The PR value chain in India encompasses several vital activities, including:

-

Strategy Development: Involves creating comprehensive communication strategies tailored to the client’s goals and objectives. This includes understanding the target audience, setting measurable goals, and defining the key messages.

-

Media Relations:Building relationships with journalists, bloggers, and other media professionals to ensure positive media coverage. This includes activities like press release distribution, media pitching, and organising press conferences.

-

Content Creation:Developing content that resonates with target audiences across various platforms, including press releases, blogs, social media posts, and multimedia content. Effective content creation is vital for storytelling and building brand narratives.

-

Digital Management:Leveraging digital tools and platforms to monitor, analyse, and optimise real-time PR campaigns. This includes social media management, SEO, data analytics, and digital content marketing.

-

Measurement and Evaluation: Using data analytics to measure the effectiveness of PR campaigns and demonstrate ROI to clients. Key performance indicators (KPIs) include media coverage, social media engagement, website traffic, and audience sentiment.

7.2 Opportunities Analysis

-

Emerging Sectors: High-growth sectors such as fintech, healthcare, and IT offer significant opportunities for PR firms to expand their client base. These sectors require specialised PR services to navigate regulatory challenges, build thought leadership, and manage crises.

-

Regional Expansion:The increasing focus on regional PR in Tier 2 and 3 cities represents new avenues for growth. PR firms can capitalise on the demand for localised content and community engagement strategies.

-

Digital PR and Content Marketing: The rise of digital PR and content marketing opens up new revenue streams, allowing firms to offer innovative solutions to clients. The shift toward online media consumption and influencer marketing creates opportunities for PR agencies to diversify their service offerings.

7.3 Product Life Cycle

The product life cycle of PR services varies:

-

Traditional Media Relations:In the maturity stage, facing competition from digital alternatives. While still relevant, traditional media relations are complemented by digital strategies to remain effective.

-

Digital PR and Content Marketing:In the growth stage, characterised by high demand and increasing adoption. These services offer higher margins and provide measurable outcomes through analytics tools.

-

AI-Driven PR Solutions:These are in the introduction stage and have significant potential for growth as technology becomes more accessible. Forward-thinking PR firms increasingly adopt AI-driven solutions like media monitoring, sentiment analysis, and predictive analytics.

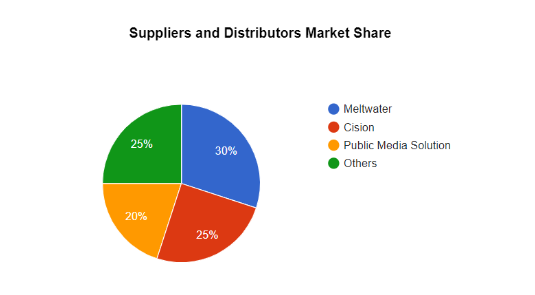

7.4 Suppliers and Distributors Market Share

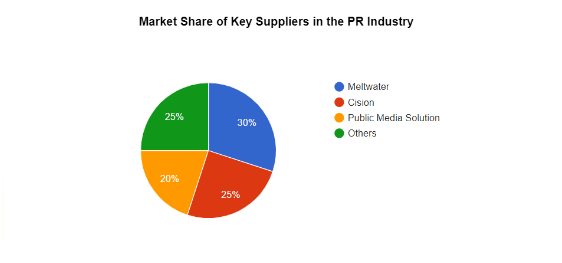

Key suppliers and distributors in the PR industry's market share are influenced by their ability to offer innovative solutions, maintain strong relationships with media and clients and provide comprehensive digital tools. Leading suppliers like Meltwater, Cision, and Public Media Solution have positioned themselves as essential partners by offering advanced media monitoring software, data analytics platforms, and content management systems.

For instance, Meltwater's media intelligence platform offers real-time monitoring and analytics across various channels, enabling PR professionals to track brand mentions, analyse sentiment, and measure campaign impact. Similarly, Public Media Solution provides integrated digital tools that combine AI-driven insights with traditional PR strategies, helping clients optimise their communication efforts.

These suppliers have captured a significant market share by continuously innovating and enlarging their product offerings to meet PR firms' and clients' evolving needs. As digital adoption grows, suppliers that provide agile, scalable, and data-driven solutions will likely maintain or increase their market share.

8. Public Relations Market - By End-User (Market Size - $Million / $Billion)

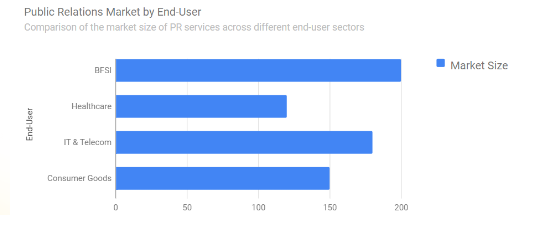

The Indian PR market is segmented by end-user industries, each with specific needs and growth potential:

8.1 BFSI (Banking, Financial Services, and Insurance)

The BFSI sector is one of the largest end-users of PR services in India, with a market size estimated at $200 million in 2023. Banks, financial institutions, and insurance companies invest heavily in PR to manage reputational risks, ensure regulatory compliance, and enhance customer trust. PR firms specialising in BFSI provide crisis communication, regulatory advocacy, and digital PR strategies to navigate the complex regulatory landscape.

employed to handle reputational issues related to financial fraud or cybersecurity breaches.

8.2 Consumer Goods and Retail

Consumer goods and retail companies rely on PR to build brand visibility, manage product launches, and engage customers. The market size for PR services in this sector is around $150 million, driven by the need for influencer marketing, social media engagement, and experiential marketing campaigns. The rise of e-commerce and digital shopping trends has further accelerated the adoption of digital PR strategies.

8.3 Government and Public Sector

The government and public sector are significant users of PR services, especially in areas like public awareness campaigns, policy communication, and crisis management. The market size is estimated to be around $100 million, with a strong focus on regional PR to address India's diverse linguistic and cultural landscape. PR firms work closely with government agencies to develop communication strategies that effectively reach target audiences nationwide.

8.4 Healthcare

The healthcare sector has seen a surge in demand for PR services, with a market size estimated at $120 million. This growth is driven by the need to build trust, manage crises, and communicate effectively with patients, stakeholders, and the public, particularly in light of the COVID-19 pandemic. PR firms increasingly focus on digital PR, content marketing, and influencer engagement to enhance patient outreach and education.

For instance, campaigns highlighting the importance of vaccination, public health awareness, and health-tech innovations have been crucial in engaging with a broader audience and establishing credibility for healthcare providers.

8.5 IT & Telecom

The IT and telecom sectors are among the fastest-growing end-users of PR services in India. PR is vital in shaping public perception and creating credibility as companies navigate rapid technological changes, data privacy concerns, and intense competition. The market is estimated at $180 million, with demand for thought leadership, product launches, and crisis communication services. Digital PR strategies, such as content marketing and social media engagement, are particularly prominent in this sector.

8.6 Entertainment

The entertainment industry, including film, television, music, and digital content, relies heavily on PR for promotion, crisis management, and audience engagement. The market size for PR services in this sector is around $80 million. The rise of OTT platforms and digital content consumption has further fueled the demand for PR campaigns that leverage social media, influencer marketing, and content partnerships.

8.7 Hospitality

The hospitality sector, encompassing hotels, travel agencies, and tourism boards, uses PR to build brand reputation, manage crises, and engage with customers. The market size is estimated at $70 million, with an increasing focus on digital PR strategies to reach global audiences and enhance brand visibility.

8.8 Food and Beverage

PR is critical in the food and beverage industry for managing product launches, building brand loyalty, and engaging with consumers. The market size is around $60 million, driven by the need for influencer marketing, social media engagement, and crisis management related to food safety and health concerns.

8.9 Others

Other sectors, such as education, automotive, and real estate, also utilise PR services, contributing to a market size of around $100 million. These sectors rely on PR for reputation management, stakeholder engagement, and digital marketing strategies.

9. Public Relations Market - By Solution (Market Size - $Million / $Billion)

PR firms in India offer various solutions tailored to their clients' specific needs. The market size for each solution type reflects the growing demand for specialized services.

9.1 Publishing Tool

Publishing tools, including press release distribution platforms and content marketing management systems, are essential for creating and distributing news and updates. The market size for publishing tools in India is estimated at $50 million, focusing on enhancing the reach and impact of PR campaigns through digital channels.

9.2 Social Media Monitoring Management

Social media monitoring tools are vital for tracking brand mentions, sentiment analysis, and audience engagement. The market size is estimated at $70 million, managed by the increasing importance of social media in shaping public perception and managing online reputations

9.3 Content Creation and Distribution

Content creation and distribution tools help PR professionals develop compelling narratives and distribute them across multiple platforms. The market size for these tools is around $90 million, with growing demand for high-quality, engaging content that resonates with target audiences.

9.4 Data Aggregation, Monitoring, and Analysis

Data aggregation and analysis tools provide insights into campaign performance, audience behaviour, and market trends. The market size is estimated at $60 million, reflecting the need for data-driven decision-making in PR strategies.

9.5 Relationship Management

Customer Relationship Management (CRM) tools manage relationships with clients, media, and stakeholders. The market size for relationship management tools in the PR industry is around $40 million, emphasising maintaining solid relationships and building long-term partnerships.

10. Public Relations - By Deployment (Market Size - $Million / $Billion)

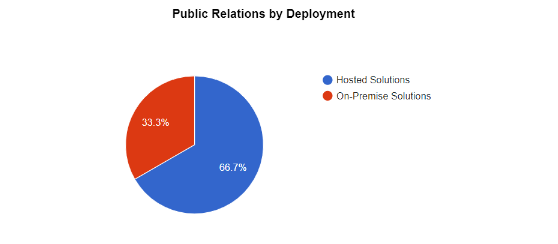

The PR market can be categorized based on the deployment methods of PR tools and solutions, which include hosted (cloud-based) and on-premise models. Both deployment methods cater to PR firms and their client's different needs and preferences, influencing their market size and growth potential.

Hosted solutions, or cloud-based PR tools and platforms, offer flexibility, scalability, and cost-effectiveness. These solutions enable PR firms to access advanced tools for media monitoring, analytics, content management, and collaboration without requiring substantial upfront investments in IT infrastructure.

The need for real-time collaboration, data access, and remote work capabilities drives the demand for hosted solutions. The market size for hosted PR solutions is estimated to be around $80 million, with growth propelled by several factors:

-

Scalability:Cloud-based solutions allow PR firms to scale their operations based on client demand and campaign requirements, offering a cost-efficient way to manage resources.

-

Remote Access:With remote and hybrid work models becoming more prevalent, PR professionals require access to tools and data from anywhere, increasing the attractiveness of hosted solutions.

-

Integration Capabilities:Cloud-based platforms integrate easily with other digital tools, such as CRM systems, social media platforms, and data analytics tools, enabling a seamless workflow for PR teams.

-

Lower Total Cost of Ownership (TCO): Cloud-based platforms operate on a subscription model, reducing the need for significant upfront capital expenditure and ongoing maintenance costs.

Key players in the hosted solutions market, such as Meltwater, Cision, and Public Media Solution, have expanded their service offerings to include advanced analytics, AI-driven insights, and social media management tools, further driving the growth of this segment.

10.2 On-Premise Solutions

On-premise PR solutions involve deploying software and tools on the organization’s servers and IT infrastructure, providing greater control, customization, and security. The market size for on-premise PR solutions is estimated at $40 million, reflecting their relevance in sectors where data security and compliance with regulatory standards are paramount.

Despite the growing adoption of cloud-based alternatives, on-premise solutions remain essential for organisations that require:

-

Enhanced Data Security and Compliance:Industries like finance and healthcare prioritize data privacy and must comply with stringent regulatory requirements (such as GDPR HIPAA). On-premise solutions offer these organisations greater control over their data and security protocols.

-

Customizability: On-premise solutions allow organizations to tailor PR tools and software to their specific needs, integrating them with other legacy systems and applications critical to their operations.

-

Reliability: For some organisations, on-premise solutions offer better reliability and performance, especially when internet connectivity is inconsistent or limited.

11. Public Relations - By Application Type (Market Size - $Million / $Billion)

11.1 Online Medium

Online PR platforms, including social media, blogs, and websites, have become integral to PR strategies. The market size for online PR applications is estimated at $100 million, driven by increasing digital consumption and the need for real-time audience engagement.

11.2 Content Marketing

Content marketing is a component of modern PR strategies. It involves creating and distributing valuable, useful content to engage audiences. The market size for content marketing in PR is around $90 million, reflecting the growing demand for high-quality content that builds brand authority and trust.

12. Public Relations - By Geography (Market Size - $Million / $Billion)

The geographic segmentation of the PR market reveals key regional trends and growth opportunities across different markets.

12.1 Public Relations Market - North America Segment Research

-

Market Overview:The North American PR market is one of the largest globally, with a market size of over $5 billion. The U.S. is the dominant market, driven by a high demand for integrated communication strategies, digital PR, and crisis management services.

-

Trends:There is a growing focus on diversity and inclusion, sustainability communication, and data-driven PR strategies.

-

Key Players:Companies like Edelman, Weber Shandwick, and FleishmanHillard dominate the market with comprehensive service offerings.

12.2 Public Relations - South America Segment Research

-

Market Overview:The South American PR market is valued at approximately $1 billion, with Brazil, Argentina, and Colombia being the key markets. Political communication, public affairs, and social media engagement drive the demand for PR services.

-

Trends: An increasing focus on digital PR and influencer marketing is reshaping the industry landscape.

-

Key Players:Local agencies like JeffreyGroup and SmartPR are expanding their footprints by leveraging regional expertise.

12.3 Public Relations - Europe Segment Research

-

Market Overview:The European PR market is valued at around $7 billion, with the UK, Germany, and France being the most significant markets. The demand is fueled by a strong focus on corporate social responsibility (CSR) communication, crisis management, and public affairs.

-

Trends:Integrating digital tools, data analytics, and AI drives regional growth.

-

Key Players:Global PR firms like Edelman, Hill+Knowlton Strategies, and Brunswick Group have a strong presence in the European market.

12.4 Public Relations - APAC Segment Research

-

Market Overview: The Asia-Pacific (APAC) PR market is valued at approximately $3.5 billion, with China, India, and Australia being the major markets. Rapid economic growth, digital adoption, and increasing corporate focus on reputation management drive the demand for PR services.

-

Trends: Regional PR is gaining traction, and digital PR is experiencing exponential growth.

-

Key Players:Companies like Adfactors PR, Ruder Finn, and BlueFocus are critical players in the APAC region.

12.5 Public Relations - Middle East and Africa Segment Research

-

Market Overview:The Middle East and Africa PR market is valued at around $1.5 billion. Key markets include the UAE, Saudi Arabia, and South Africa, where demand for PR services is driven by government communication, public diplomacy, and crisis management.

-

Trends: There is a growing focus on digital PR, content localization, and cross-cultural communication.

-

Key Players:Firms like ASDA’A BCW and Hill+Knowlton Strategies are prominent in the MEA region.

13. Public Relations Market - Entropy

13.1 New Product Launches

The PR market is witnessing numerous new product launches, particularly in digital tools and analytics platforms. Innovations include AI-driven media monitoring tools, automated content creation software, and data analytics platforms designed to optimize PR campaigns. Companies increasingly launch products that provide real-time insights and measurable outcomes, addressing the growing demand for data-driven PR solutions.

These new products enable PR firms to enhance their service offerings by providing advanced capabilities for sentiment analysis, audience targeting, and campaign measurement. For example, AI-powered tools can analyse vast media data in real-time, allowing PR professionals to identify emerging trends, track brand sentiment, and make data-driven decisions.

13.2 M&A, Collaborations, JVs, and Partnerships

Mergers, acquisitions, joint ventures, and partnerships reshape the PR landscape. Significant deals include acquiring smaller digital PR firms by larger global agencies, collaborations between PR and technology companies, and strategic alliances to expand market reach and capabilities.

These activities reflect a trend towards consolidation and integration within the industry as firms seek to improve their digital capabilities and expand their service offerings. Notable examples include agencies to strengthen acquiring digital agencies in their digital and social media capabilities and partnerships between PR agencies and analytics firms to offer data-driven PR solutions.

14. Public Relations Market - Industry/Segment Competition Landscape

14.1 Market Share Analysis

-

By Country: The U.S., China, and the UK hold the most significant shares of the global PR market. The U.S. market is characterized by its size and diversity, with numerous PR firms catering to various industries. China’s PR market is growing rapidly due to increasing demand for corporate communication services, while the UK remains a hub for strategic PR services in Europe.

-

By Region:North America and Europe dominate the global PR market, but the Asia-Pacific region is experiencing rapid growth, driven by digital adoption and economic expansion. In contrast, the Middle East and Africa, while smaller in market size, are becoming increasingly significant due to geopolitical developments and public diplomacy needs.

-

By Application:Digital PR, social media management, and content marketing are gaining the most significant market shares, reflecting the shift towards online communication channels and the need for real-time engagement.

-

By Product: Tools for media monitoring, social media management, and data analytics are among the top products in the PR market. The demand for these tools is growing as PR firms seek to enhance their capabilities in monitoring, analyzing, and optimising their communication strategies.

-

At the Global Level: The top 10 companies, including Edelman, Weber Shandwick, Hill+Knowlton Strategies, and Public Media Solution, collectively hold a significant share of the global PR market. These firms have established strong market positions through their comprehensive service offerings, global reach, and ability to adapt to changing market dynamics.

14.2 Best Practices for Companies

Best practices for PR companies include:

-

Adopting a Client-Centric Approach:Focusing on understanding client requirements and delivering tailored solutions aligned with their strategic objectives.

-

Integrating Digital Tools and Technologies:Leveraging digital tools, Artificial Intelligence (A)I and data analytics to enhance campaign effectiveness, measure ROI, and provide real-time insights.

-

Focusing on Data-Driven Decision Making: Using data to inform strategy development, optimize campaign performance, and demonstrate value to clients.

-

Maintaining Ethical Standards:Adhering to industry standards and ethical guidelines to build trust and credibility with clients and stakeholders.

-

Investing in Continuous Learning and Upskilling: Encouraging professional development and training to keep up with industry trends and technological advancements.

15. Public Relations Market - Key Players in the PR Technology Space

The digital transformation of Public Relations (PR) has led to the emergence of specialized technology companies that cater to the evolving needs of the industry. These companies provide a range of tools and platforms focused on media monitoring, campaign management, content distribution, influencer marketing, and customer relationship management (CRM). Here’s an in-depth analysis of some prominent players in the PR technology space:

15.1 Company Analysis

1. Google Inc.

Specialization: AI and Data Analytics for Digital PR

Google has become a pivotal player in digital PR by leveraging its expertise in artificial intelligence (AI) and data analytics. Its solutions, such as Google Analytics and Google Ads, help PR professionals in tracking audience behavior, enhancing media monitoring, and improving audience targeting. With its emphasis on machine learning and AI-driven insights, Google enables PR firms to create more effective and data-driven communication strategies.

Key Strengths:

- Advanced tools for keyword analysis, sentiment tracking, and competitive benchmarking.

- AI-driven media monitoring through Google Alerts and other proprietary tools.

- Enhanced audience targeting capabilities through Google’s ad platform.

2. Salesforce

Specialization: Customer Relationship Management (CRM) for PR

Salesforce is a global leader in CRM solutions, providing comprehensive tools that are critical for relationship management in PR. With its Salesforce Marketing Cloud, PR firms can better manage client interactions, track communication history, and segment audiences for personalized campaigns. It allows for more effective management of media relations, ensuring streamlined communication and better customer engagement.

Key Strengths:

- Centralized platform for managing client relationships and communication.

- Tools for tracking and measuring client interactions.

- Integration with social media platforms for enhanced audience insights.

3. Cision US Inc.

Specialization: Media Monitoring and Analytics for PR Campaigns

Cision is a prominent name in the PR industry, known for its media monitoring and analytics solutions. Its platform helps PR professionals track media mentions, analyze the impact of their campaigns, and optimize communication strategies. With its comprehensive database of journalists and influencers, Cision enables targeted outreach, making it easier for PR firms to build and maintain media relationships.

Key Strengths:

- Advanced media monitoring and reporting capabilities.

- Database of over 1.6 million journalists and influencers for targeted outreach.

- Tools for measuring PR performance and campaign effectiveness.

4. Meltwater Inc.

Specialization:Media Intelligence and Social Listening

Meltwater provides media intelligence solutions that allow PR firms to monitor brand mentions, analyze public sentiment, and track trends across social media platforms. Its social listening tools are invaluable for understanding audience perceptions and identifying emerging opportunities for client engagement. Meltwater’s platform offers real-time data, enabling PR professionals to react quickly to changes in public opinion.

Key Strengths:

- Comprehensive social listening and sentiment analysis tools.

- Real-time tracking of media mentions and trending topics.

- Analytics for gauging campaign impact and brand perception.

5. Zoho Corporation Pvt. Ltd.

Specialization: Integrated Marketing and PR Solutions

Zoho provides an array of integrated marketing and PR tools that simplify content creation, distribution, and performance measurement. With its suite of applications, including Zoho Campaigns, Zoho Social, and Zoho CRM, the company enables PR professionals to execute and monitor their campaigns seamlessly across multiple digital channels. Zoho’s affordability and ease of use make it a popular choice for small to mid-sized PR firms.

Key Strengths:

- Integrated platform for managing PR and marketing campaigns.

- Tools for social media management, email marketing, and content distribution.

- Customizable dashboards for performance tracking and analytics.

6. IRIS Software Group Ltd.

Specialization:PR Management Software Solutions

IRIS Software Group offers PR management software designed to streamline workflow management, media relations, and campaign tracking. Its solutions are ideal for agencies looking to optimize their internal processes, track campaign performance, and maintain comprehensive records of client communication. IRIS’s software solutions are known for their efficiency and ability to handle complex PR workflows.

Key Strengths:

- Workflow management tools for organizing campaigns and media activities.

- Centralized database for managing media contacts and communication.

- Real-time tracking and reporting for campaign progress.

7. Isentia

Specialization: Media Monitoring and Insights in the Asia-Pacific Region

Isentia is a leading media monitoring and intelligence company, with a strong presence in the Asia-Pacific region. The company specializes in providing actionable insights that help PR firms understand market dynamics and audience behavior. With its focus on regional markets, Isentia offers tailored solutions that address the unique challenges and opportunities of the Asia-Pacific PR landscape.

Key Strengths:

- In-depth media monitoring and analysis for the Asia-Pacific region.

- Real-time insights into regional audience behavior and trends.

- Localized tools and expertise for navigating regional media.

8. Onalytica

Specialization:Influencer Marketing Tools

Onalytica specializes in influencer marketing and relationship management. Its platform enables PR firms to identify key influencers, track their activities, and engage them effectively for campaigns. Onalytica’s influencer analytics tools provide insights into an influencer’s reach, engagement, and relevance, making it easier for PR professionals to execute targeted influencer outreach strategies.

Key Strengths:

- Comprehensive database of influencers across multiple industries.

- Tools for measuring influencer impact and engagement.

- Strategic insights for executing effective influencer campaigns.

9. Outbrain Inc.

Specialization:

Content Recommendation and Native Advertising

Outbrain offers content recommendation and native advertising solutions that help PR firms amplify their content and reach wider audiences. By promoting content through native ads, Outbrain enables PR professionals to increase brand visibility and engagement. Its platform is particularly effective for content-driven PR strategies, helping firms target specific demographics with precision.

Key Strengths:

- Content amplification through native advertising.

- Tools for targeting specific audience segments.

- Analytics for measuring content performance and engagement.

10. Prezly

Specialization: PR Management and Media Relations Tools

Prezly is a PR software company that focuses on simplifying media outreach, content distribution, and reporting. Its platform provides tools for managing media contacts, distributing press releases, and tracking media engagement. Prezly’s user-friendly interface and automation features make it easy for PR firms to manage their day-to-day activities efficiently.

Key Strengths:

- Media relations tools for managing and nurturing journalist relationships.

- Automation features for content distribution and follow-ups.

- Customizable reporting to track PR outcomes and media coverage.

16. Public Relations Market - Appendix

16.1 Abbreviations

- PR: Public Relations

- PRCAI: Public Relations Consultants Association of India

- CRM: Customer Relationship Management

- AI: Artificial Intelligence

- VC: Venture Capital

- CSR: Corporate Social Responsibility

- PMS : Public Media Solution

16.2 Sources

1. Public Relations Consultants Association of India (PRCAI) Reports

PRCAI provides industry insights, best practices, and trends in the Indian PR industry. You can access their reports and publications through their official website: PRCAI Reports

2. SPRIN.T: St.udy of Public Relations Insights, Nuggets, and Trends 2022-23

The SPRINT report comprehensively analyses the Indian PR landscape, including market size, growth rates, and trends. For more information, visit the PRCAI website: SPRINT Report.

3. Industry Databases (Statista, MarketLine)

Statista and MarketLine provide market data, statistics, and analysis for various industries, including PR. Access their platforms for more information:

- Statista

- MarketLine

4. Company Annual Reports

Annual reports from companies like Edelman, Weber Shandwick, and others offer insights into their financial performance, strategic direction, and market positioning. Visit the respective company websites for detailed reports:

5. Expert Interviews and Industry Publications

Insights gathered from industry leaders and publications such as PRWeek, The Holmes Report, and PRovoke provide expert analysis and commentary on the PR industry. Explore their platforms for in-depth articles and interviews:

These sources provide a strong foundation for understanding the current state and future trends of the Public Relations industry in India and globally.

17. Public Relations Market - Methodology

17.1 Research Methodology

The research methodology for this report on the Indian Public Relations Market is based on a combination of primary and secondary research techniques. The approach ensures comprehensive coverage of the market dynamics, competitive landscape, trends, and growth opportunities in the PR industry. The following methods were employed to gather, analyze, and interpret data:

1. Company Expert Interviews:

Interviews with industry leaders, senior executives, and key decision-makers from top PR firms provided valuable insights into market trends, challenges, and opportunities. These discussions helped us understand the industry's leading players' strategic priorities, competitive positioning, and future outlook.

2. Industry Databases:

Market data and statistics were sourced from reputable industry databases such as Statista, MarketLine, and others. These databases provided detailed information on market size, growth rates, segmentation, and competitive dynamics. The data from these sources was cross-verified with other research to ensure accuracy and reliability.

3. Associations:

Information was obtained from professional associations, including the Public Relations Consultants Association of India (PRCAI), the Public Relations Society of America (PRSA), and the International Association for Measurement and Evaluation of Communication (AMEC). These organizations offer industry guidelines, regulatory updates, best practices, and insights into emerging trends in the PR market.

4. Company News:

Press releases, news articles, and official company statements were analysed to identify new product launches, mergers, acquisitions, partnerships, and other strategic activities. This information helped us understand how companies position themselves in the market and respond to evolving industry dynamics.

5. Application Trends:

The study examined trends in using digital tools, social media platforms, and content marketing strategies in the PR industry. This analysis focused on how PR firms adapt to technological advancements and changing client demands, such as integrating AI, data analytics, and automation into PR campaigns.

6. New Products:

Research on recent product launches and innovations in digital tools, analytics platforms, and PR management software provided insights into technological advancements shaping the future of PR. The analysis included evaluating the impact of new tools like AI-driven media monitoring and automated content creation software on market growth.

7. Company Transcripts:

I reviewed earnings calls, investor presentations, and company transcripts to gain insights into leading PR firms' financial performance, strategic direction, and growth prospects. This information helped me understand how companies invest in new technologies and expand their service offerings to stay competitive.

8. R&D Trends:

Data on research and development (R&D) activities in the PR industry were analyzed to highlight areas of innovation and growth. The focus was on understanding how companies leverage R&D to develop new tools, improve service delivery, and enhance client satisfaction.

9. Key Opinion Leaders Interviews:

Insights from interviews with key opinion leaders (KOLs) in the PR industry provided perspectives on current market trends, challenges, and future opportunities. KOLs included experts from academia, industry analysts, and experienced PR professionals who offered unique viewpoints on the evolving landscape of the PR market.

10. Supply and Demand Trends:

The report analyzed supply and demand trends to assess market dynamics, including the demand for PR services across various industries and geographic regions. This analysis helped identify growth opportunities and potential industry challenges, such as talent shortages, pricing pressures, and competition from digital marketing alternatives.

This multi-pronged research approach ensured that the report offers a holistic and accurate overview of the Indian Public Relations Market, providing actionable insights for stakeholders, including PR firms, clients, investors, and policymakers.